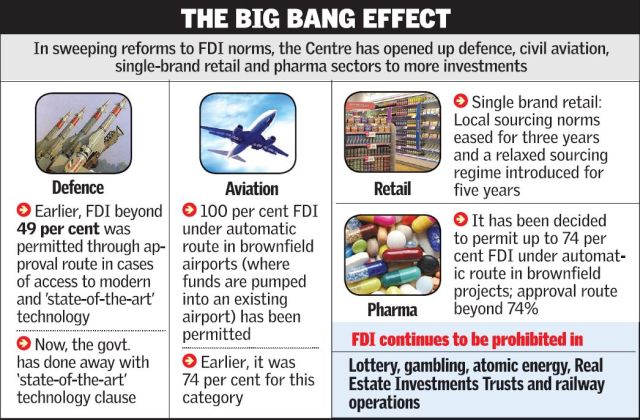

The much awaited Foreign Direct Investment (FDI) reforms announced by the Modi government recently are expected to have far-reaching and durable impact on the health of the India's economy. However, there has been insufficient appreciation of the government for it having had the courage to take these decisions, given that elements in the Sangh Parivar itself have been viscerally opposed to FDI in key sectors of the economy. A slew of economic reforms announced by the government have taken away the cap on FDI and thus effectively shut down a long festering debate on the issue.

Now the doors of investment in manufacturing in sectors ranging from defence to pharmaceuticals, and services ranging from airlines to insurance and single brand retailing have been finally opened.

In political terms, these confirm that it is the Prime Minister Narendra Modi, whose writ runs strong in the government as well as in their Alma Mater- Sangh Parivar. Economically, the reforms signal a virtual change of tack, as it were. Given that there is no fresh credit off-take, with the corporates weighed down by excessive debt, and the continuing global slowdown, what best way to rev up the economic engine than to get foreign dollars to boost growth.

Foreign investments in key sectors of the economy such as defence, aviation, cable TV, food retailing, pharma, can not only create new jobs but also make up for the sluggishness of Indian corporates to make fresh investments.

The drive to clean up the bank balance-sheets has, in fact, antagonised the corporate world against the Modi government. Anyway, since fresh investment in business and industry is not forthcoming, there could be no better way than to allow FDI to set up tent here in carefully designated areas. Defence, for instance, is a key sector in which India has lagged behind in indigenisation despite tens of thousands of crores being poured in organisations like the Defence Research and Development Organisation. The short-sighted decision to keep even the indigenous private sector out of basic defence manufacturing has only meant that India continues to rely on foreign manufacturers for meeting even its needs for rudimentary defence supplies. Therefore, Monday's decision to allow 100 per cent FDI in defence makes sense. To be based on case-by-case approval, FDI in defence can create local jobs while allowing foreign investors to make and supply to India what they have been hitherto doing from their plants outside the country. Transfer of technology and local partnerships are bound to follow once foreign manufacturers begin operations in India.

Single brand retail, too, has got a pass for three years, extendable to five, for opening one hundred per cent, fully-owned, dedicated stores. Iconic global brand names like Apple and furniture major Ikea will provide consumers a whole new experience which should help change the overall image of the Indian marketplace. The pharma sector also could see changes with the flow of foreign funds, with more and more companies acquiring new R&D muscle and acquiring global standards. Brownfield airports could take flying closer to millions who stay in small towns away from the big metros.

Foreign funds in cable TV and mobile phone television, too, could raise the game in these sectors and make it world class. With Monday's decisions, the flow of foreign funds can only grow further. In a globalised economy, it always helps to facilitate the flow of funds rather than choke that flow with artificial barriers based on old ideological shibboleths and unfounded fears of foreigners. Economies have got where there have by welcoming, and not rejecting, foreign investments.

While theoretically, India will never be the same again as it is now expected to become a market-friendly and efficient economy with little space left for cronyism. But let's not rush to conclusions. India is still not an easy place to do business in. It still ranks 130 out of 189 in the World Bank's ease of doing business rankings.